- #AFFINITY FEDERAL CREDIT UNION FULL#

- #AFFINITY FEDERAL CREDIT UNION VERIFICATION#

- #AFFINITY FEDERAL CREDIT UNION PLUS#

- #AFFINITY FEDERAL CREDIT UNION FREE#

Their goals, and Affinity exists to see their members financially succeed.Īffinity Savings Challenge was in place, leadership knew that creatively communicating This savings challenge campaign idea stemmed from theįact that Americans simply don’t save enough money for emergencies or to reach Save their money, save their time, and save on interest, fees etc. The goal of Affinity’s initiative is to encourage members to

The ones who are saving are not saving very much – only 16% are saving more than 15% of their income.īeyond offering products with favorable rates, how can Credit Unions help their members save more? Affinity Federal Credit Union’s answer: start the conversation and incentivize members to save.īasking Ridge, NJ launched a new initiative in 2019 called the Great Affinity In fact, a recent survey from reports that more than one in five of those working Americans don’t save any of their annual income.

#AFFINITY FEDERAL CREDIT UNION FREE#

You can learn more about getting the best deal on your next home loan without paying unnecessary discount points or fees by checking out my free Underground Mortgage Videos.Working Americans are still struggling when it comes to saving money. The more you pay the less benefit you’re getting from today’s low refinance rates. The fees you pay closing on your home loan make or break the deal you’re getting. Overall I am unimpressed with Affinity Credit Union saying one thing and doing another. The mortgage rates published on the website were also higher than I’ve seen from other lenders like Amerisave and Navy Federal Credit Union. I would question why Affinity Credit Union claims not to charge a loan origination fee and then turns around and charges $300. The quote I received was laced with junk fees despite the $300 loan origination fee.ĭo you and an experience or an opinion of Affinity Federal Credit Union that you’d like to share? Please leave a comment below!

#AFFINITY FEDERAL CREDIT UNION VERIFICATION#

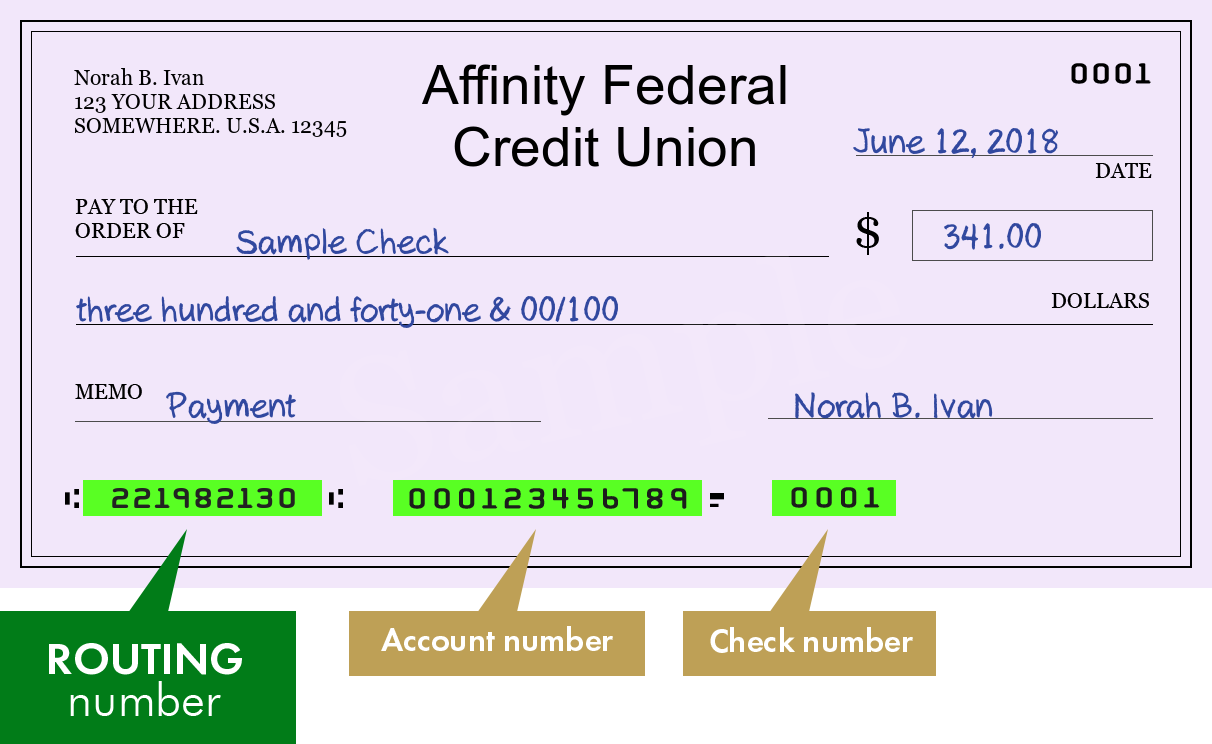

While $300 is dirt-cheap it is still not zero.ĪFCU required a $450 appraisal fee, $175 attorney review fee, a courier fee of $25 (pure garbage), employment verification fee $16.40 (also garbage), credit report fee of $26.60 (really? Overcharged), and a tax service fee of $65 (more garbage fees). The website claims a zero origination fee however, when I requested a quote I was presented a $300 loan origination fee. I was able to request a rate quote online and received a disclosure of fees. Purchase and mortgage refinancing rates are published on the website alongside the Annual Percentage Rate (APR) and do not include discount points. I would avoid 40-year term-lengths completely as choosing this type of home loan is a common mortgage mistake. AFCU offers fixed-rate home loan with term-lengths ranging from 10 to 30 years.

#AFFINITY FEDERAL CREDIT UNION PLUS#

Zero origination fee is a plus for Affinity FCU.

Lender fees and rate lock fees are widely considered junk fees however, the loan origination fee is standard and a reasonable amount to pay is one percent of your mortgage amount. They claim to have no lender fee, rate lock fee, or origination fee on your purchase or mortgage refinance loan. The real-estate section claims to save you an average of $2,862 on closing costs. The website is feature-rich and easy to navigate. (800) 325-0808 24 Hour Live Representativeīasking Ridge, NJ 07920 Affinity Federal Credit Union Review If you’re not employed by a one of the 2,000 participating businesses you can join a sponsored association or club to become eligible for membership. Founded in 1935, Affinity Federal Credit Union is headquartered in Basking Ridge, New Jersey.Īffinity FCU claims that just about everyone is eligible for membership.

#AFFINITY FEDERAL CREDIT UNION FULL#

They are a member-owned, non-profit, full service credit union with 17 branches in northern/central New Jersey. According to the NCUA, AFCU has 134,410 members and $2,139,801,102 in assets. Should you trust Affinity FCU with your next mortgage loan or are their home loans laced with junk fees?Īffinity Federal Credit Union claims to be New Jersey’s largest credit union. Affinity Federal Credit Union claims to be the largest credit union in New Jersey, serving 134,410 members.

0 kommentar(er)

0 kommentar(er)